If the money order has been cashed, the issuer will not replace it or refund the purchase amount. But if the money order goes missing, you have a good chance of getting your money back—minus a fee and a few weeks’ delay—as long as it hasn’t been cashed.

How do I get my money back from a stolen money order?

But generally speaking, here’s what you need to do:

- Contact the issuer of the money order. The first thing to do if you’re sure that your money order is lost is to contact the issuer.

- Fill out the cancellation request form.

- Pay the money order cancellation fee.

- Allow your cancellation request time to process.

How can you tell if someone cashed your money order?

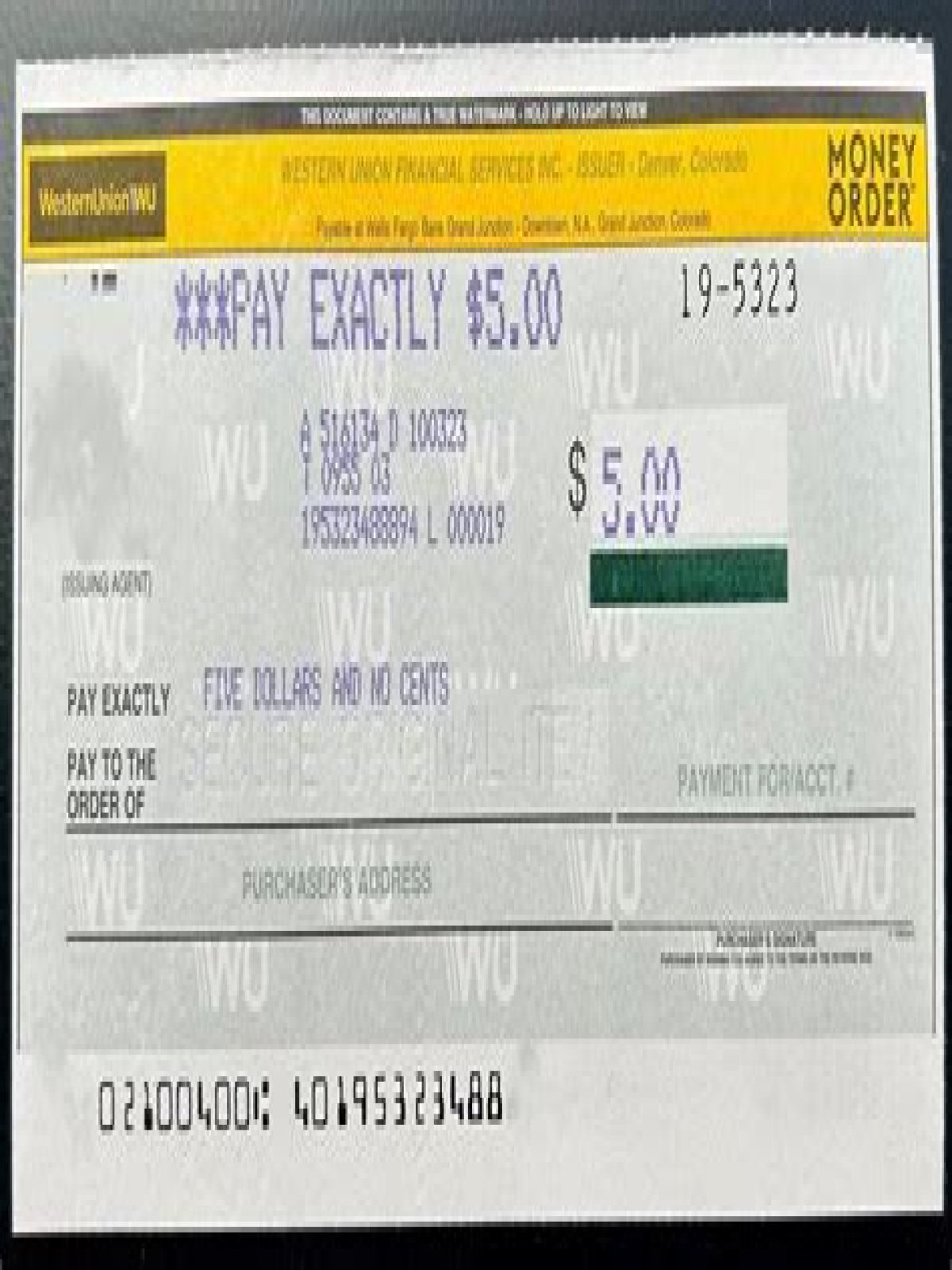

Customers wanting to find out if a money order has been cashed may go online to USPS.com to check the status. They will need to enter the money order serial number, Post Office number, and issued amount—all printed on the money order receipt—in order to obtain near real-time status information.

How long can you hold a money order before cashing it?

No. However, depending upon the state of purchase, if you do not use or cash the money order within one to three years of the purchase date, a non-refundable service charge will be deducted from the principal amount (where permitted by law).

Can you void a money order?

Can you cancel a money order? You can cancel a money order that hasn’t been cashed. (If it’s already been cashed, skip ahead.) If you’re not sure about your money order’s status, you can track it by calling the issuer’s customer service number or using the tracking feature on its website.

How do I change a money order to cash?

How to Cash a Money Order

- Bring your money order to a location that will cash it. You can take the money order to your bank, credit union, grocery store, and some retail stores.

- Endorse your money order.

- Verify your identity.

- Pay service fees.

- Receive your cash.

Is it possible to cash a money order?

The ability to cash money orders easily means criminals sometimes ask you to send them funds in that form as part of more traditional phishing scams and other schemes aimed at separating you from your money. Many of these could extract payment by check, credit card or electronic transfer as well.

Can a check be stolen with a money order?

In short: Cash can be stolen. And with a personal check, a company may not want to take the risk of receiving it, because your check may not clear. If you send a money order, the recipient doesn’t have to worry about that. Are Money Orders Theft-Proof?

What’s the difference between a check and a money order?

Money orders, unlike a personal check, offer a guaranteed form of payment. After all, a check can bounce.

How does a money order payment method work?

The payment method is a secure alternative to personal checks and wire transfers. How Do Money Orders Work? Money orders are typically cheaper than a lot of other forms of transferring money.