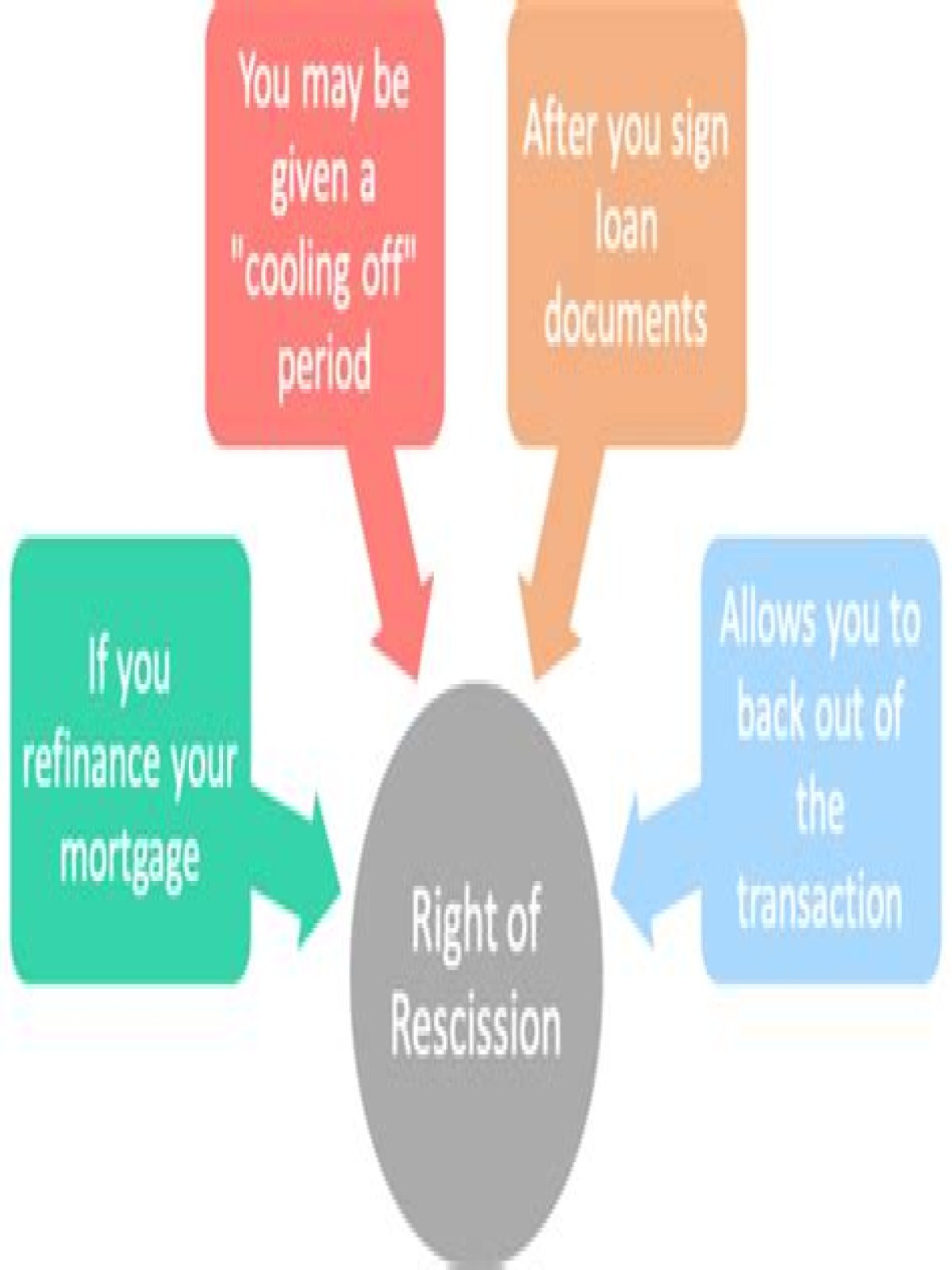

The right of rescission, created by the Federal Truth in Lending Act, gives homeowners the absolute right to cancel a home equity loan, or line of credit, until midnight of the third day after closing, excluding federal holidays and Sundays. This is considered the right of rescission.

- Does Saturday count for right of rescission?

- What does the right to rescind mean?

- Can a lender cancel a loan after signing?

- What days count as rescission days?

- What is the 3 day rule in real estate?

- Can you change your mind after making an offer on a house?

- Who gets a right of rescission?

- What does rescission date mean?

- Why does it take 3 days to close on a house?

- What happens if you back out before closing?

Does Saturday count for right of rescission?

Please note that the day that you sign your loan documents, public holidays and Sundays do not count against the three day right of rescission period; however, Saturdays do count against the three days. The three day rescission period does not apply to home purchase mortgages.

Can you waive 3 day right of rescission?

Yes. You can waive your right of rescission (your right to cancel your transaction within three business days for your refinance or home equity line of credit).

What does the right to rescind mean?

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

Can a lender cancel a loan after signing?

The lender has no right of rescission. Once you have signed loan documents, you have entered into a binding contract, and the lender is legally bound to honor those signed documents. The right of rescission is a separate form giving you three days in which you can back out of the transaction without penalty.

Do second homes have right of rescission?

There Isn’t a Rescission Period on All Mortgage Transactions Additionally, vacation/second homes and investment properties do not have a rescission period, even if it is a refinance transaction!

What days count as rescission days?

The rescission date is three business days after the signing date, the date the borrower receives the Truth in Lending Disclosure, or the date the borrower receives the “Notice of Right to Cancel”, whichever occurs last. In some cases Saturday may not be considered a business day.

What is the 3 day rule in real estate?

Three Business-Day Waiting Period The CFPB final rule requires the lender to give the borrower three business days to thoroughly review the Closing Disclosure to enable them to compare the charges to the loan estimate and ensure the cost and loan program they are obtaining are as expected.

Can you back out of a loan before closing?

You can back out of a mortgage before closing If you failed to rate shop before settling on a lender, you might develop a case of borrower’s remorse. The surest way to be unhappy with your mortgage is to find out that a friend snagged a lower interest rate through another lender.

Can you change your mind after making an offer on a house?

Can you back out of an accepted offer? The short answer: yes. When you sign a purchase agreement for real estate, you’re legally bound to the contract terms, and you’ll give the seller an upfront deposit called earnest money.

Who gets a right of rescission?

The right of rescission is the right of a borrower to cancel a home equity loan, line of credit or refinancing agreement within a 3-day period without financial penalty. It was born out of the Truth in Lending Act (TILA).

Is there a three day right of rescission for a second home?

Generally, only second mortgage-type home equity loans and lines of credit, as well as certain refinanced mortgages, qualify for rescission. The three-day rescission period also applies when you refinance your current mortgage loan with a different lender.

What does rescission date mean?

The definition of a rescission date is the day a contract is overturned. An example of a rescission date is the date the insurance company cancels an insurance policy because of misrepresentation by the person who signed up for the insurance.

Why does it take 3 days to close on a house?

One of the important requirements of the rule means that you’ll receive your new, easier-to-use closing document, the Closing Disclosure, three business days before closing. This will give you more time to understand your mortgage terms and costs, so that you know before you owe.

How long after loan estimate can you close?

Loan estimate vs. closing disclosure

| Document | When you get it | No. of pages |

|---|---|---|

| Loan estimate | Within 3 business days after applying for a loan | 3 |

| Closing disclosure | At least 3 business days before closing your loan | 5 |

What happens if you back out before closing?

When a seller backs out of a purchase contract, not only will the buyer have their earnest money returned, but they may also be able to sue for damages or even sue for specific performance, where a court can order the seller to complete the sale.