Taxable property and services are purchased out of state for use in New Jersey, and no Sales Tax is collected. The purchaser owes Use Tax; Taxable property and services are purchased out of state for use in New Jersey, and Sales Tax is collected at a lower rate than New Jersey’s.

Do I need to collect Sales Tax in NJ?

New Jersey requires vendors to collect Sales Tax on all taxable sales made in this State. This includes online sales of products or services delivered to New Jersey. Collect Sales Tax on all taxable transactions and remit the taxes to the State; File New Jersey Tax returns (personal and/or business) if appropriate; and.

Who pays NJ Sales Tax?

When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State. The law exempts some sales and services from Sales Tax.

Do I owe NJ use tax?

Because New Jersey’s tax rate is higher than Maine’s, you owe Use Tax for the difference between taxes paid in Maine and what you would have paid had you purchased the item in New Jersey.

What is the sales and use tax in New Jersey?

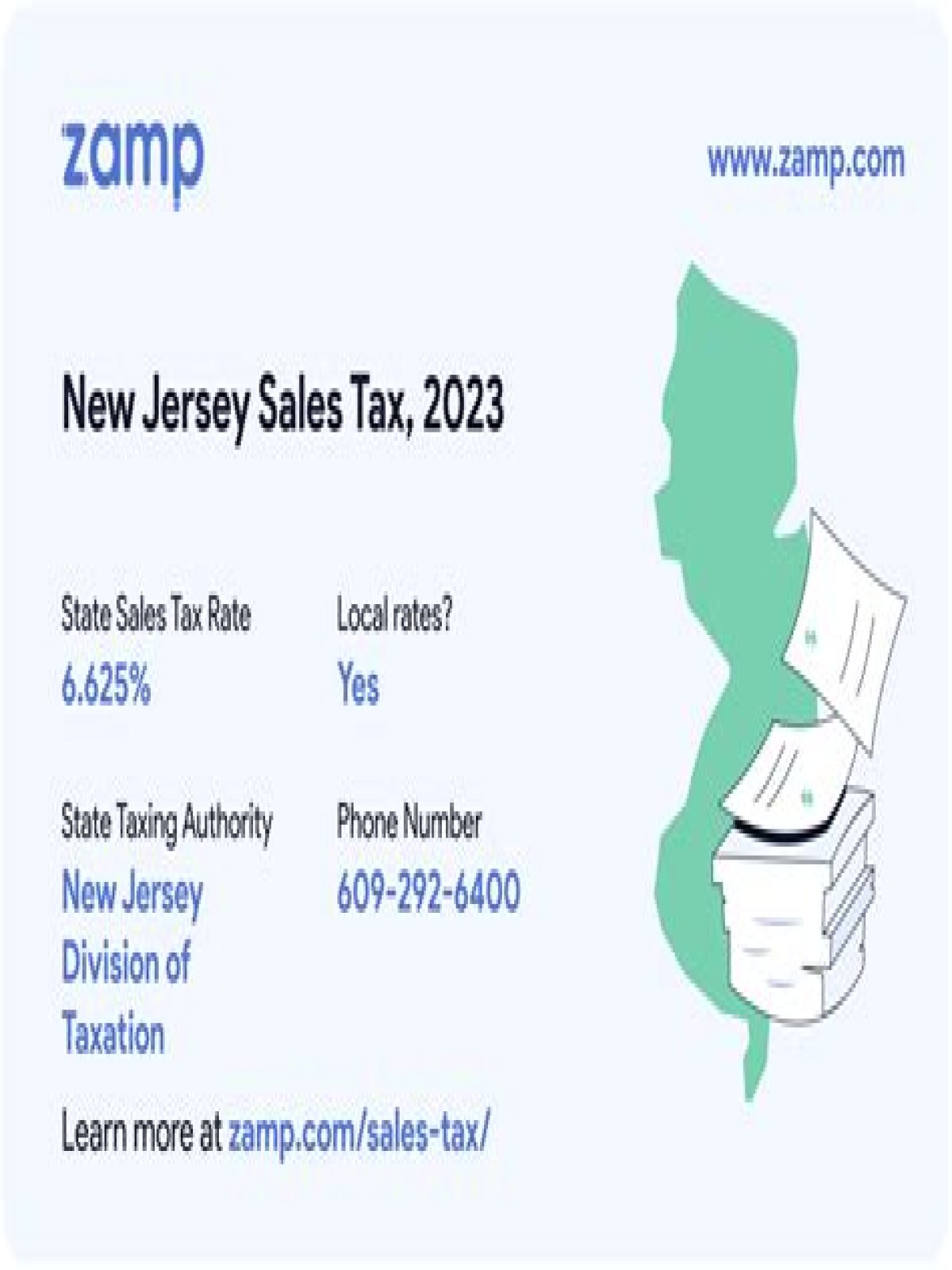

Effective January 1, 2018, the New Jersey Sales and Use Tax Rate is 6.625%.

Who needs to pay Sales Tax in NJ?

How does sales tax work in New Jersey?

New Jersey Sales Tax and You: An Overview. When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State.

Who is the tax collector in New Jersey?

As a business owner selling taxable goods or services, you act as an agent of the state of New Jersey by collecting tax from purchasers and passing it along to the appropriate tax authority. As of March 2019, sales and use tax in New Jersey is administered by the New Jersey Division of Taxation.

Which is an example of a nontaxable item in New Jersey?

Some examples of nontaxable goods and services are: Unprepared food for human consumption, clothing, certain professional and personal services, and real estate sales. Publication S&U-4, New Jersey Sales Tax Guide, provides further information on Sales Tax. It includes extensive listings of taxable and exempt items and services.

How to find New Jersey Division of taxation?

(The Division of Taxation has created publications to help answer your questions on an array of topics. Use the search box at the right hand side of the publications menu to search for Sales Tax items or select the arrow next to “Tax Type” find publications by tax type.)