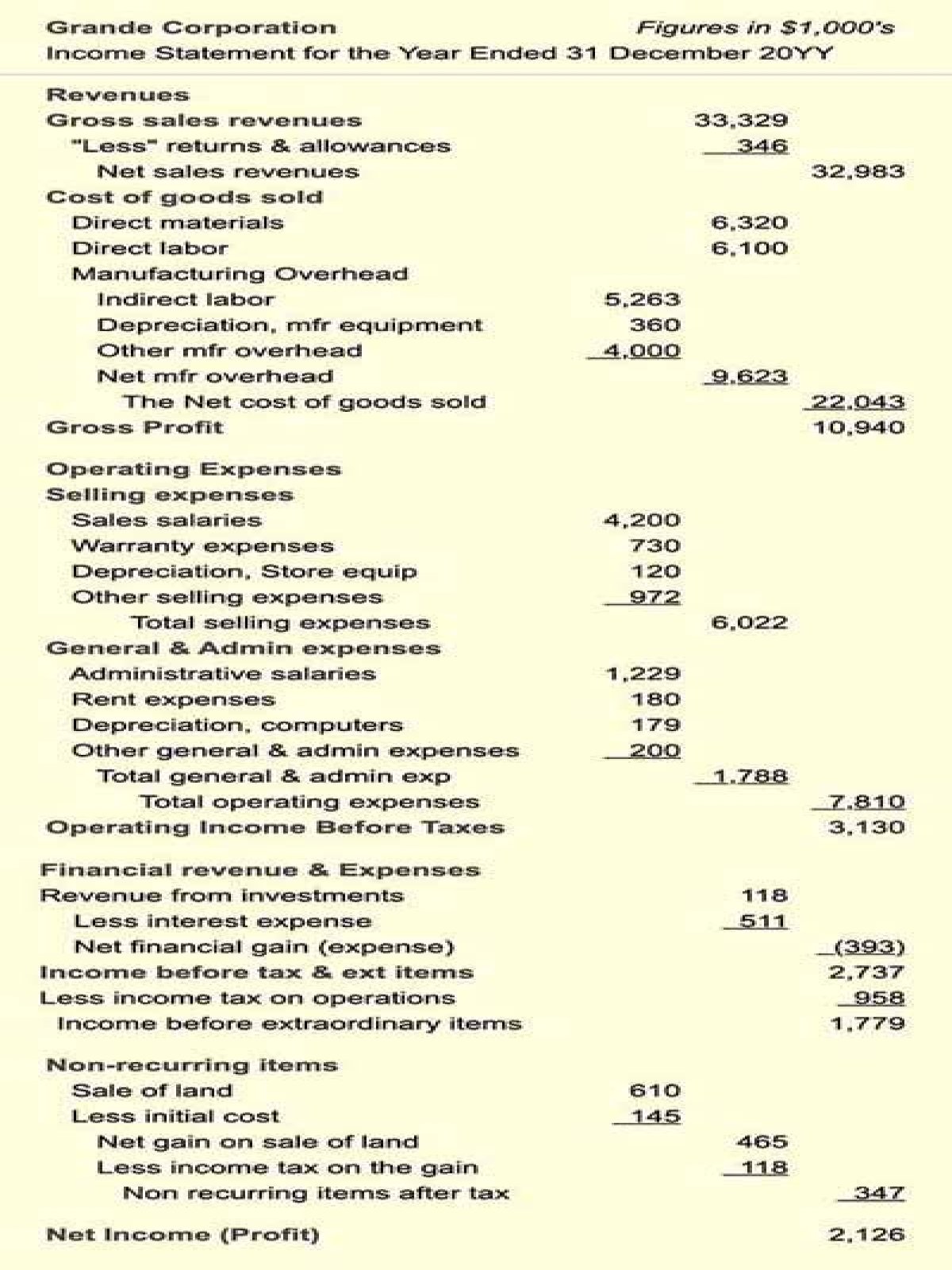

Depreciation expense is reported on the income statement as any other normal business expense. If the asset is used for production, the expense is listed in the operating expenses area of the income statement. This amount reflects a portion of the acquisition cost of the asset for production purposes.

Do you include depreciation in profit and loss?

Depreciation is the profit and loss account cost of fixed assets. This is achieved via a depreciation charge which is made to reduce the value of the fixed asset in the balance sheet and include the depreciation cost in the profit and loss account on a regular basis.

How does depreciation affect the statement of cash flows?

In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow. Due to this depreciation does not impact the cash. However, depreciation does have an indirect impact on cash flow.

Where do you find depreciation on a balance sheet?

Depreciation is found on the income statement, balance sheet, and cash flow statement. Depreciation can be somewhat arbitrary which causes the value of assets to be based on the best estimate in most cases.

How does net income affect cash flow statement?

Put simply, lower taxes lead to increased net income, and as net income is often used as a starting point to calculate a business’s operating cash flow (along with net change in operating working capital and other adjustments), you’ll end up with a higher amount of cash on your cash flow statement. What’s the net depreciation effect on cash flow?

Why is depreciation a non cash operating activity?

Depreciation is therefore a non-cash operating activity which is the result of qualitative wear and tear in the use of asset but it has been quantified by the use of accounting principles and assumptions in line with enterprise’s own accounting policies.