7.25% 2021 Local Sales Tax Rates

| As of January 1, 2021 | ||

|---|---|---|

| State | State Sales Tax Rate | Combined Sales Tax Rate |

| California (b) | 7.25% | 8.68% |

| Colorado | 2.90% | 7.72% |

| Connecticut | 6.35% | 6.35% |

What is the highest sales tax in California?

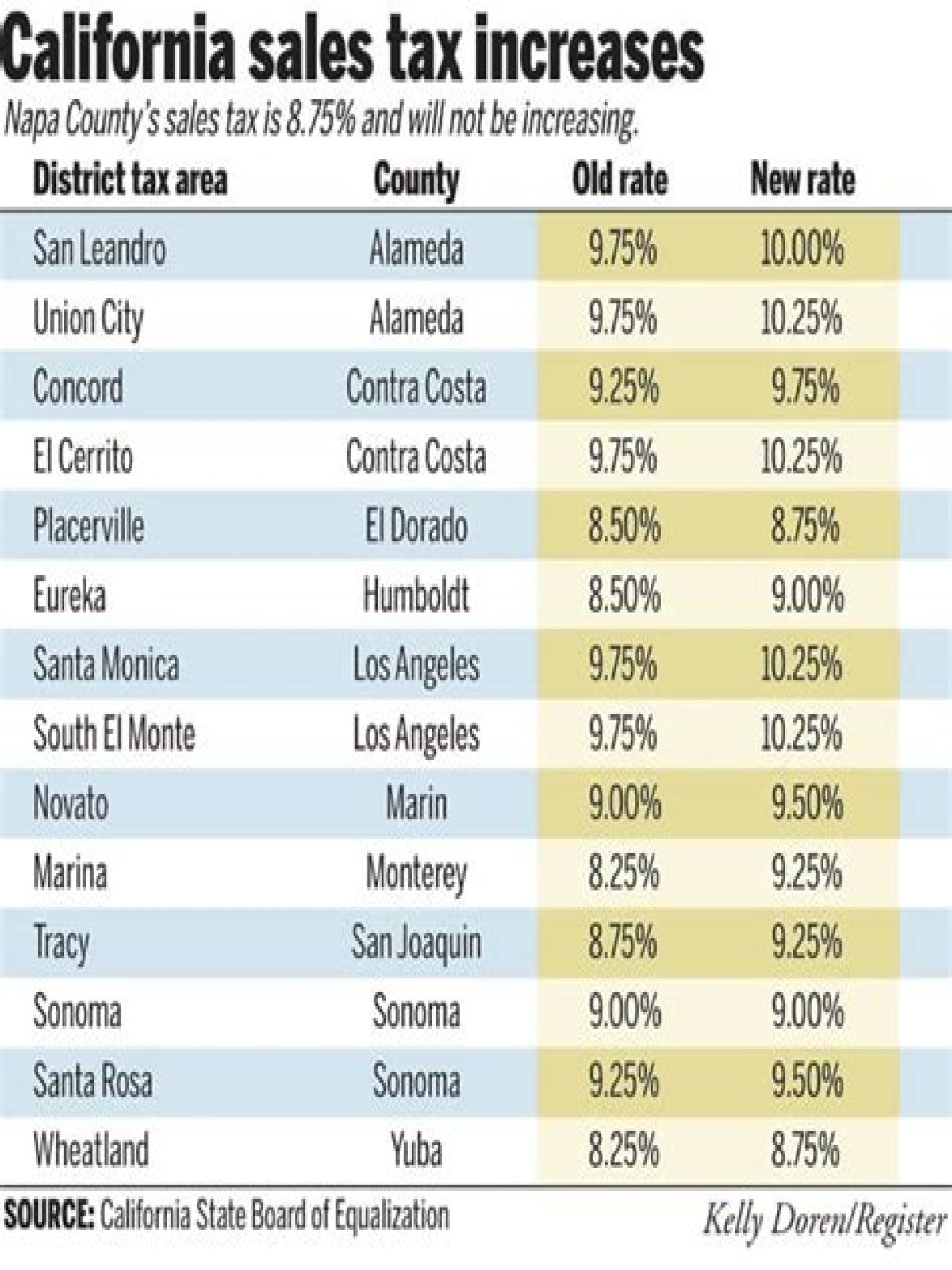

10.75% California: Sales Tax Handbook Combined with the state sales tax, the highest sales tax rate in California is 10.75% in the cities of Hayward, San Leandro, Alameda, Union City and Newark (and one other cities).

What is the sales tax in Los Angeles 2020?

Los Angeles County, California sales tax rate details The California state sales tax rate is currently 6%. The Los Angeles County sales tax rate is 0.25%.

What is the tax on $1 in California?

California state tax rates and tax brackets

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 1% | $0 to $8,932 | 1% of taxable income |

| 2% | $8,933 to $21,175 | $89.32 plus 2% of the amount over $8,932 |

| 4% | $21,176 to $33,421 | $334.18 plus 4% of the amount over $21,175 |

| 6% | $33,422 to $46,394 | $824.02 plus 6% of the amount over $33,421 |

Who has highest state sales tax?

Here are the 10 states with the highest sales tax rates:

- California (7.25%)

- Indiana (7.00%)

- Mississippi (7.00%)

- Rhode Island (7.00%)

- Tennessee (7.00%)

- Minnesota (6.88%)

- Nevada (6.85%)

- New Jersey (6.63%)

What state has no sales tax?

Most states have sales tax to help generate revenue for its operations – but five states currently have no sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

What is not taxed in California?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

Does California have a high sales tax?

At 7.25%, California has the highest minimum statewide sales tax rate in the United States, which can total up to 10.75% with local sales taxes included.

Who has the highest sales tax?

Some of the highest combined state and local sales taxes:

- Chicago, Illinois and Long Beach, California: 10.25 percent.

- Birmingham and Montgomery, Alabama and Baton Rouge and New Orleans, Louisiana: 10 percent.

- Seattle and Tacoma, Washington: 9.6 percent.

What taxes do you pay in Los Angeles?

Los Angeles, California sales tax rate details The minimum combined 2021 sales tax rate for Los Angeles, California is 9.5%. This is the total of state, county and city sales tax rates. The California sales tax rate is currently 6%. The County sales tax rate is 0.25%.

How are sales and use taxes in California?

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate, and any district tax rate that may be in effect. State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific state fund allocations, and to other local jurisdictions.

What kind of taxes do you pay when you sell a house in California?

When this document is submitted, there will be a tax for the transfer of ownership known as the transfer tax. This tax is typically paid to the county but also sometimes the city depending on where you are located. The cities of Los Angeles, Riverside, and San Francisco collect their own city transfer taxes.

What was the last sales tax rate in California?

There is also 302 out of 2793 zip codes in California that are being charged city sales tax for a ratio of 10.813%. The last rates update has been made on July 2021.

How are 2020 sales taxes calculated in California?

How 2020 Sales taxes are calculated in California The state general sales tax rate of California is 6%. Cities and/or municipalities of California are allowed to collect their own rate that can get up to 1.75% in city sales tax.