Divide the total amount of your weekly or bi-weekly gross pay by your hourly pay rate. The result is the number of hours you worked during the pay period.

How do you calculate regular rate of pay?

This is calculated by dividing the total pay for employment (except for the statutory exclusions) in any workweek by the total number of hours actually worked to determine the regular rate.

What is 3 hours and 10 minutes as a decimal?

Common Time to Hours, Minutes, and Seconds Decimal Values

| Time | Hours | Minutes |

|---|---|---|

| 02:50:00 | 2.833 hrs | 170 min |

| 03:00:00 | 3 hrs | 180 min |

| 03:10:00 | 3.167 hrs | 190 min |

| 03:20:00 | 3.333 hrs | 200 min |

What is considered regular rate of pay?

An employee’s regular rate is the hourly rate an employee is paid for all non-overtime hours worked in a workweek. 29 CFR 778.108; 29 USC 207(e); Walling v.

What is blended pay rate?

What are Blended Rates? The federal government’s Fair Labor Standards Act requires that when work is performed at two or more rates, overtime must be paid out at a blended rate. A “blended rate” is a rate of not less than one-and-a-half times the weighted average of all non-overtime rates used during that workweek.

What is 1 hour 20 minutes as a Decimal?

Common Time to Hours, Minutes, and Seconds Decimal Values

| Time | Hours | Minutes |

|---|---|---|

| 01:00:00 | 1 hr | 60 min |

| 01:10:00 | 1.167 hrs | 70 min |

| 01:20:00 | 1.333 hrs | 80 min |

| 01:30:00 | 1.5 hrs | 90 min |

- What is 3 hours and 10 minutes as a decimal?

- What is 3 hours and 20 minutes as a Decimal?

- What is excluded from regular rate of pay?

- What is 3 hours and 20 minutes as a decimal?

- How do I calculate my pay rate?

- What is the formula for hourly wage?

- How much is $11 an hour after taxes?

- What’s the hourly rate for 2, 087 hours?

What is 3 hours and 20 minutes as a Decimal?

Hours and minutes to Decimal conversion So, 3 hours 20 minutes is 3 + 20 ÷ 60 = 3.333333 hours.

What is the rate of pay?

: the amount of money workers are paid per hour, week, etc.

What is excluded from regular rate of pay?

Section 7(e)(2) of the FLSA allows an employer to exclude from the regular rate of pay “payments made for occasional periods when no work is performed due to vacation, holiday, illness, failure of the employer to provide sufficient work, or other similar cause.”

How does blended pay work?

What is blended hourly rate?

In their simplest form a blended rate is when a law firm offers the services of two or more staff members at the same hourly rate when the staff members are normally billed at different hourly rates.

What is 3 hours and 30 minutes as a decimal?

Common Time to Hours, Minutes, and Seconds Decimal Values

| Time | Hours | Seconds |

|---|---|---|

| 03:10:00 | 3.167 hrs | 11,400 sec |

| 03:20:00 | 3.333 hrs | 12,000 sec |

| 03:30:00 | 3.5 hrs | 12,600 sec |

| 03:40:00 | 3.667 hrs | 13,200 sec |

What is 3 hours and 20 minutes as a decimal?

What is 3 2 as a Decimal?

How to Write 3/2 as a Decimal?

| Fraction | Decimal | Percentage |

|---|---|---|

| 3/2 | 1.5 | 150% |

| 3/3 | 1 | 100% |

| 3/4 | 0.75 | 75% |

| 3/5 | 0.6 | 60% |

You do this by dividing the minutes worked by 60. You then have the hours and minutes in numerical form, which you can multiply by the wage rate. For example, if your employee works 38 hours and 27 minutes this week, you divide 27 by 60. This gives you 0.45, for a total of 38.45 hours.

How do I calculate my pay rate?

Divide your annual salary by your hours worked in a year. For instance, if you work 40 hours a week, or 2,080 hours a year, and make $50,000 a year, your calculation would be $50,000 divided by 2,080 equals 24.038, which would convert into $24.04 per hour. This makes your rate of pay $24.04 per hour.

What is the largest deduction from a paycheck?

The biggest statutory payroll tax deduction is for the federal income taxes themselves.

Do you get paid for 30 minutes?

Bona-fide meal periods (typically 30 minutes or more) are not work time, and an employer does not have to pay for them. However, the employees must be completely relieved from duty. When choosing to automatically deduct 30-minutes per shift, the employer must ensure that the employees are receiving the full meal break.

What is last pay rate?

Final rate of pay means the actual rate upon which earnings of an employee were calculated during the twelve (12) month period immediately preceding the.

What is the formula for hourly wage?

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Next, divide this number from the annual salary. For example, if an employee has a salary of $50,000 and works 40 hours per week, the hourly rate is $50,000/2,080 (40 x 52) = $24.04.

Should I claim 0 or 1 if I am married?

The more allowances you claim, the lower the amount of tax withheld from your paycheck. Use the Personal Allowances Worksheet attached to the W-4 form to calculate the right number for you. A married couple with no children, and both having jobs should claim one allowance each.

How much is $11 an hour after taxes?

$11 an hour after taxes is $17,160 a year if you were taxed at 25%. The amount you pay in taxes depends on many different factors. But assuming a 25% to 30% tax rate is pretty standard.

How much is $9 an hour after taxes?

| Hourly Wages After Taxes (approx.) | ||

|---|---|---|

| $75.90 | ||

| $9 hour | ||

| $9 hr x 40hrs = $360 week | Taxes for Single claiming 1 Exemption: | |

| $360 – $64.85 taxes = $295.15 weekly take home pay | $29.77 |

How to calculate your pay based on your hourly rate?

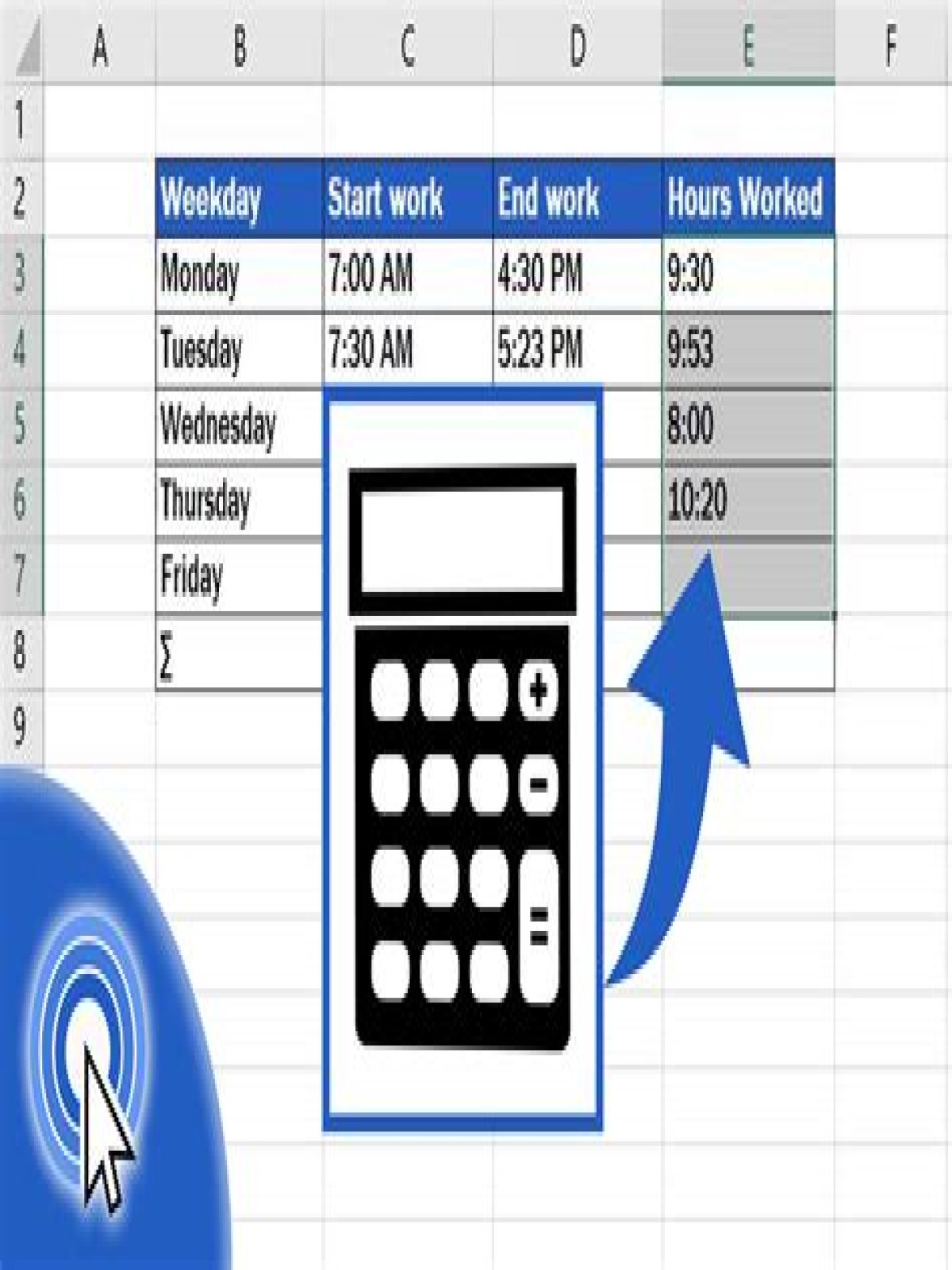

Calculating Regular Wages Based on Hourly Pay Know your hourly pay rate. Record your hours worked. Keep track of overtime. Multiply your hours worked by the pay rate. Add on any bonuses. Account for deductions. Estimate your annual wages.

How do you calculate the total number of hours worked?

Multiply your hours worked by the pay rate. Take your total number of hours at your base pay rate and multiply it by the rate. If you have additional hours at a second rate (overtime or weekend, for example), multiply those hours times that rate separately. Then add the two numbers together.

What’s the hourly rate for 2, 087 hours?

The employee’s hourly rate of basic pay is $42.66 ($89,033/2,087 hours). The employee’s biweekly rate of basic pay is $3,412.80 ($42.66 x 80 hours). The pay the employee will actually receive is $88,733 ($3,412.80 x 26 pay dates).

How to calculate the overtime rate for a week?

The algorithm behind this overtime calculator is based on these formulas: PAPR = Pay period (52 for Weekly, 26 for Bi-Weekly or 12 for Monthly). In case someone works in a week a number of 40 regular hours at a pay rate of $10/hour, plus an 15 overtime hours paid as double time the following figures will result: What is overtime rate?