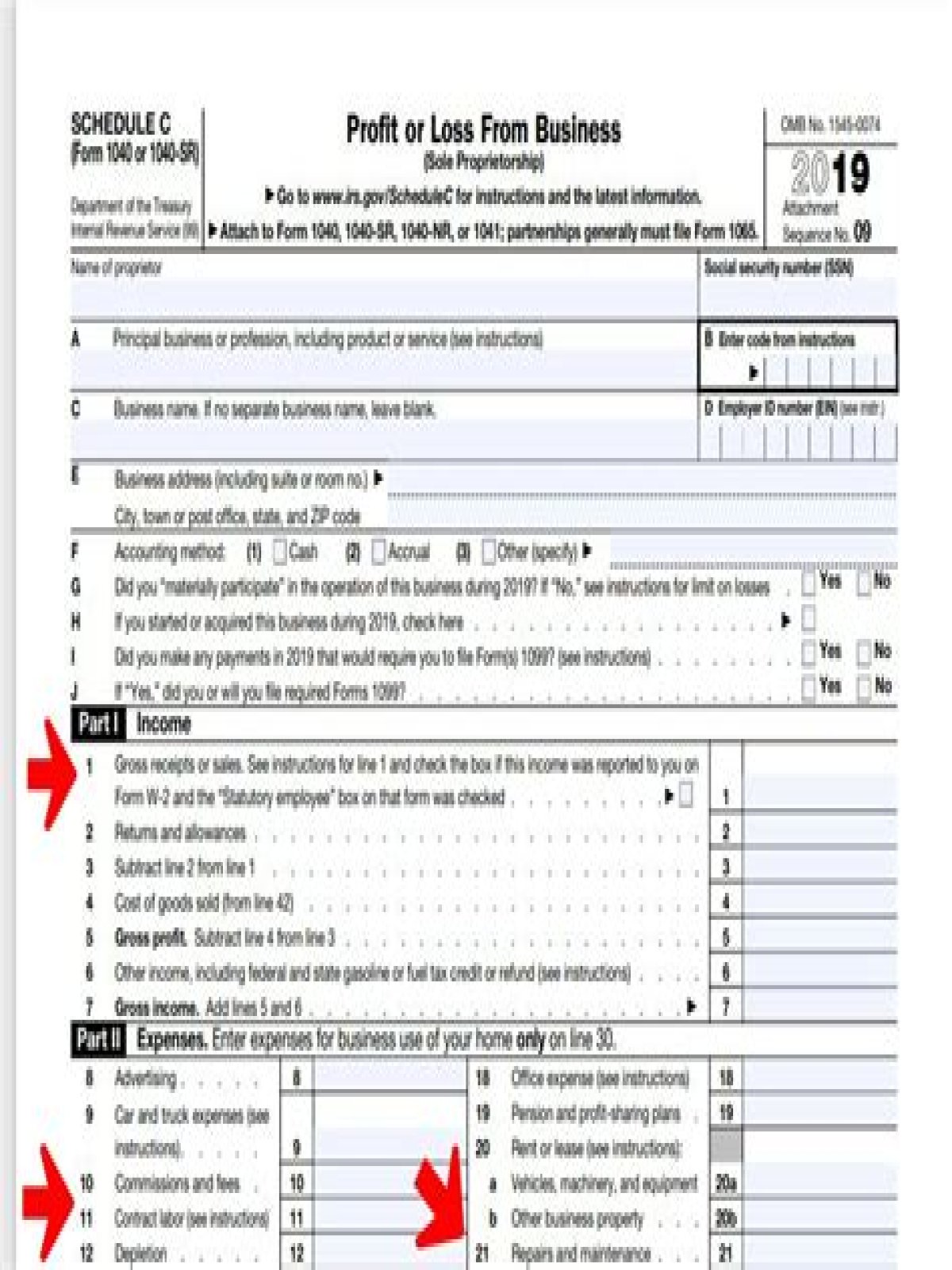

When you report the income on a Schedule C, the program will automatically calculate your self-employment taxes for you. When you receive a 1099-MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C.

How do I link 1099-MISC to Schedule C?

To link the MISC. Income to a Schedule C after selecting Continue: Click on + Create a New Schedule C Income from Business – OR – select the blue Add button to a preexisting Schedule C. Click Add a Form 1099-MISC to add an additional 1099-MISC.

Can I file a 1099-MISC without a Schedule C?

If your income is not self-employment income, you do not need to use Schedule C to report business income. Instead, the 1099-MISC income will go onto Line 8 of Schedule 1 as Other Income that is only subject to regular tax and not subject to self-employment taxes.

Does a 1099 NEC require a Schedule C?

Yes—your Form 1099-NEC will provide info that you’ll need to add to your Schedule C, which is where you report income and expense details for your business. You’ll also file Schedule SE, Self-Employment Tax, to pay your Social Security and Medicare taxes.

Does a 1099 MISC mean you are self-employed?

If you received a 1099 form instead of a W-2 , then the payer of your income did not consider you an employee and did not withhold federal income tax or Social Security and Medicare tax. A 1099-MISC or NEC means that you are classified as an independent contractor and independent contractors are self-employed.

Do you have to file Schedule C for 1099 MISC?

You’re in the business of consulting, and you have to file Schedule C to report that 1099-MISC income. This is a requirement, not an option! The good thing about filing Schedule C is the ability to apply any expenses you incurred while performing those services.

What are the scenarios for a 1099 MISC?

1099-Misc Scenario 2: Client correctly receives a 1099-Misc but has no expenses. Consuelo worked as a maid in a hotel. She received a 1099-Misc with income earned doing this work. She is required to work set hours at her employer’s business location. She uses equipment and supplies that are provided by the employer.

What does it mean to be independent contractor on 1099-MISC?

If payment for services you provided is listed in box 7 of Form 1099-MISC, Miscellaneous Income, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don’t necessarily have to have a business for payments for your services to be reported on Form 1099-MISC.

Where does Consuelo report her 1099 MISC income?

Based on the facts, Consuelo should be classified as an employee and should receive a W-2. How should Consuelo report her income? 1099-Misc should be reported on a Schedule C. She may not reasonably have any expenses. However you should probe to determine if this is correct.