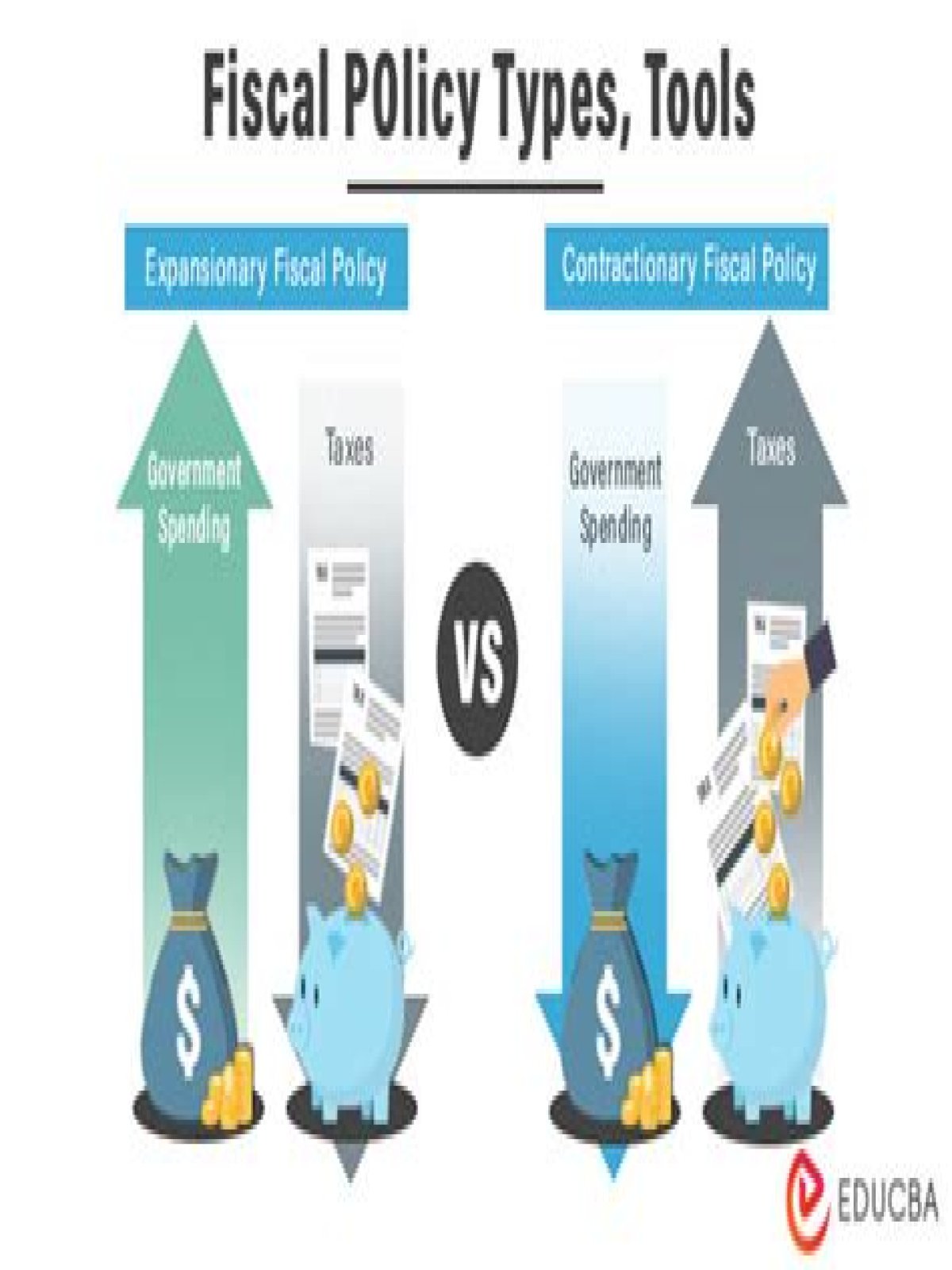

There are three types of fiscal policy: neutral policy, expansionary policy,and contractionary policy. In expansionary fiscal policy, the government spends more money than it collects through taxes.

What is fiscal policy and the tools of fiscal policy?

There are two key tools of the fiscal policy: Taxation: Funds in the form of direct and indirect taxes, capital gains from investment, etc, help the government function. Government spending has the power to raise or lower real GDP, hence it is included as a fiscal policy tool.

How is fiscal policy used?

Fiscal policy is the use of government spending and taxation to influence the economy. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty. Before 1930, an approach of limited government, or laissez-faire, prevailed.

What are the tools of fiscal policy that governments can use to stabilize an economy?

What are the two tools of fiscal policy that governments can use to stabilize an economy? government spending and taxation.

Why is government spending a fiscal policy tool?

Government spending is a fiscal policy tool because it has the power to raise or lower real GDP. By adjusting government spending, the government can influence economic output.

What does the word fiscal mean in economics?

The word ‘fiscal’ means ‘budget’ and refers to the government budget. Fiscal policy is therefore the use of government spending, taxation and transfer payments to influence aggregate demand. These are the three tools inside the fiscal policy toolkit.

How are transfer payments a fiscal policy tool?

These checks go out all over the country on a monthly basis and serve as the income for tens of millions of consumers. Transfer payments are fiscal policy tools in the same way that taxes are because changes in transfer payments lead to changes in consumer income, and when consumers spend more of their income, this influences economic output.

What are the different types of fiscal policies?

There are two types of fiscal policies. Both of these policies work well for the overall growth of the economy. But the government uses one of them at times when one is required more than the other. Let’s talk about both of these.